An extended period of global economic instability, which has given way to hyperinflation in some parts of the world, has increased many citizens’ interest in digital assets such as bitcoin (BTC) and stablecoins.

Hyperinflation – defined as uncontrollable price inflation in an economy – erodes the value of a currency and reduces its purchasing power. Cryptocurrencies have emerged as a disruptive alternative that enables individuals to preserve the value of their capital and protect themselves against a collapse in their domestic fiat currency.

Crypto Adoption Accelerates in Emerging Economies

Cryptocurrencies are viewed as highly volatile in some regions of the world, but in countries facing economic instability and severe hyperinflation, citizens consider them to be a more stable store of value and a form of safe haven.

Users in lower-middle and upper-middle-income countries are increasingly using cryptocurrencies to send remittances and convert funds out of fiat currency to avoid volatility, according to a report by US blockchain analysis firm Chainalysis.

Independence from traditional banking systems makes Bitcoin and stablecoins such as tether (USDT) and circle (USDC) appealing to such users and promotes the inclusion of those with limited banking access.

Cryptocurrencies also offer a way for emerging economies to reduce their reliance on the US dollar. While the dollar has become the global reserve currency for decades, US monetary policy on interest rates and inflation caused volatility in its value that has had implications for individuals far beyond US borders.

This is prompting emerging economies to look to de-peg their currencies from the dollar. Some have begun to promote the Chinese yuan as an alternative, particularly for trade, while El Salvador has adopted Bitcoin as a legal currency.

Soaring energy, fuel, and food prices, driven by geopolitical conflict and political instability, also drove inflation towards historic highs in 2022, fueling inflation and causing depreciation in the value of local fiat currencies.

Vietnam, the Philippines, Ukraine, and India were the four biggest cryptocurrency adopters in 2022, according to the Chainalysis Global Crypto Adoption Index.

In addition, instability in countries such as Lebanon, Turkey, Sri Lanka, and Pakistan has driven citizens to convert their funds into cryptocurrencies using peer-to-peer (P2P) trading platforms or closed social media groups.

Crypto Users Avoid Hyperinflation in Latin America

Hyperinflation continues to be a problem across Latin America, driving the adoption of cryptocurrencies as a store of value and for regular transactions. More than a third of Latin Americans had made an everyday purchase with a stablecoin as of April 2022, according to a Mastercard study.

In Argentina, for instance, year-on-year inflation surged to 104.3% in March 2023, devaluing the Argentine peso. The government has imposed strict capital controls that make it difficult for citizens to save money in their bank accounts.

They can hold only the equivalent of $200 per month at the official peso to the US dollar exchange rate of 140, although the unofficial black market “dólar blue” rate that many use is around 270 pesos to the dollar.

This restriction has prompted many Argentinians to convert money into cryptocurrencies – particularly stablecoins – to save larger sums.

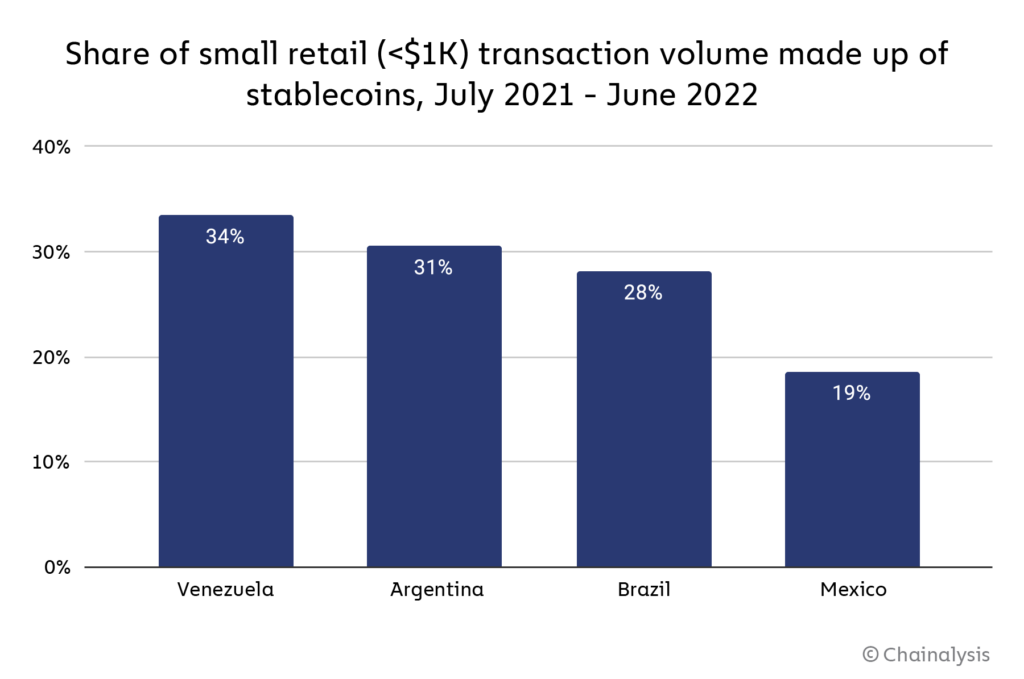

More than 31% of the cryptocurrency transaction volume among Argentina’s small retail-sized users is in the form of stablecoin sales, compared to 26% in Brazil and 18% in Mexico, according to Chainalysis.

Stablecoins are popular as they are pegged to the dollar, which Argentinians prefer to use, they are easy to access as they are digital, and there are no purchase limits, so users can convert any amount of pesos. While the peso-to-stablecoin exchange rate is typically lower than the dólar blue, stablecoins offer a sense of stability.

Small retail stablecoin transaction volume is even higher in Venezuela at 34% – more than any other country in Latin America.

Venezuela’s national currency, the Bolivar, plunged in value by more than 100,000% from December 2014 to September 2022.

The country is a rapidly growing cryptocurrency market in US dollar terms, with Venezuelans receiving $28.3 billion in cryptocurrency in 2021 and $37.4 billion in 2022, up by 32%.

Benefits of Cryptocurrencies in Inflationary Economies

There are several key drivers for emerging economies to adopt cryptocurrencies and make use of blockchain technology.

Efficient Remittances

Cross-border payments in traditional banking systems typically require intermediaries and are often characterized by long processing times and high transaction fees. This creates challenges for businesses and erodes the value of remittances sent by workers to their families abroad.

The decentralized nature of cryptocurrencies and low transaction fees offer an alternative, particularly between countries where traditional banking systems are not connected. For instance, financial institutions in Asia, such as the Philippines, Singapore, and Japan, use the Ripple blockchain to facilitate more efficient remittance payments.

El Salvador’s adoption of Bitcoin as a legal currency is also intended to address the cost of remittances and overseas transfers for its citizens. The government aims to provide its citizens with a more cost-effective and seamless way to conduct domestic and cross-border transactions.

Alternative Store of Value

When the value of local fiat currencies plunges rapidly – as they did in a number of emerging economies in 2022 – citizens turn to cryptocurrencies as a store of value to limit the impact of hyperinflation. They can convert their money to stablecoins to retain its value in US dollars or to bitcoin with the potential to make a profit if its value rises.

While Bitcoin is often viewed as a highly volatile asset in countries with relatively stable fiat currencies, the price has proved to be less volatile in 2023 than some rapidly devaluing currencies – for example, the Lebanese pound, the Turkish lira, and the Zimbabwe dollar.

Financial Inclusivity

Cryptocurrencies can play an important role in providing access to financial services to citizens in developing countries. Around 1.4 billion adults worldwide lack access to traditional banking services, according to a World Bank report.

Exclusion from the formal banking system limits individuals’ ability to send and receive payments, save money, or gain access to credit. Cryptocurrencies address this by enabling anyone with a mobile device to set up a digital wallet so that they can participate in the global economy without needing a bank account.

This can allow individuals to control their finances and start businesses. And decentralized finance (DeFi)?can facilitate the delivery of new financial services, such as lending, savings, and insurance, to them directly, without the need for centralized intermediaries.

A lack of financial inclusion and opportunity has been a significant driver of cryptocurrency adoption in Vietnam, where more than 60% of the population lives in rural areas with limited banking services.

Vietnam has also become a hub for blockchain gaming developers as well as users, where players of games such as Axie Infinity earned significant real-world income at the height of the market.

Risks of Cryptocurrency Use in Inflationary Economies

While citizens in economies with high inflation are increasingly turning to cryptocurrencies, this presents risks that governments need to address.

Policy Challenges

The growing adoption of cryptocurrencies poses challenges for policymakers and central banks, most of which have yet to implement policies and regulations guiding their use.

Cryptocurrency transactions are not reported for taxation. This results in lower tax receipts than when transactions are conducted in fiat currency and can further weaken a country’s treasury.

Cryptocurrency use also undermines capital controls, with an International Monetary Fund (IMF) study showing that adoption is highly correlated with the stringency of such controls. Blockchain transactions are a fast and cost-effective way for users to send funds across borders while avoiding capital controls.

A lack of common standards for disclosure also makes it difficult for governments to gain visibility into how cryptocurrencies are being used within their borders. And stablecoin issuers are not subject to any requirements on the composition of the reserve assets backing their coins.

Currency Substitution

Large holdings of cryptocurrency assets among individuals increase the risks of currency substitution. Substitution can result in capital outflows, weaken the effectiveness of monetary policy to influence prices, and threaten financial stability.

Links to Traditional Banking Systems

While cryptocurrencies are designed to run on fully decentralized blockchain networks, the increasing involvement of centralized institutions and the composition of stablecoin reserve assets can create links to the mainstream financial system. Problems in the traditional banking sector can then spill over into the cryptocurrency ecosystem.

For instance, US stablecoin issuer Circle held $3.3 billion of its $40 billion USD coin (USDC) reserves at Silicon Valley Bank (SVB). When SVB collapsed in March 2023, USDC briefly lost its $1 peg. That affected USDC’s market capitalization and contributed to bearish sentiment in cryptocurrency markets, even though they are intended to be independent of centralized financial institutions.

The Bottom Line

The growing adoption of cryptocurrencies in hyperinflationary economies indicates how decentralized digital assets can shape the future of financial systems in times of crisis. They can provide a measure of financial stability, cheaper and more efficient remittances, financial access for the unbanked, and economic opportunities via DeFi.

As the world continues to navigate economic uncertainty, the role of cryptocurrencies in hyperinflationary environments will continue to present benefits and challenges for individuals, businesses, and governments in emerging economies.